Although retirement for most people is thought of as a time to cut back, it can be fun if it is budgeted for. Here are some Retirement Budget Planning tips so that your retirement is a time for leisure and for having fun. Retirement Budget Planning can help you in this regard. Retirement Budget Planning is simple if you know how to do it. A budget is basically a statement of how much money is coming in and how much is going out. If you can balance the two, you will never make the common mistake of spending too much money too soon after retirement.

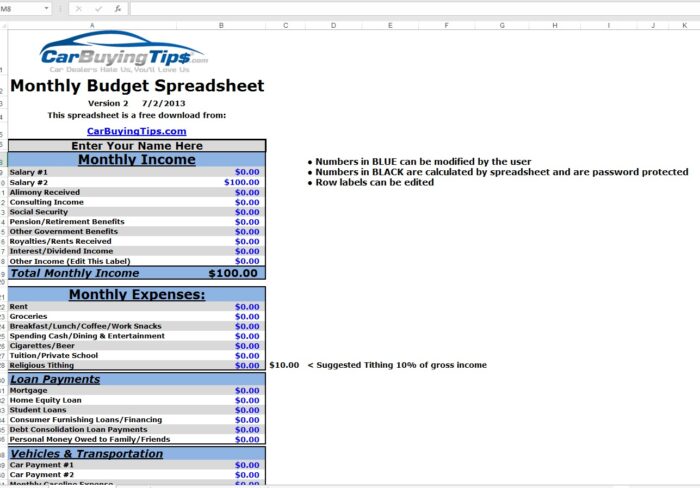

Your retirement income is going to be affected by many factors. These are inflation, taxes, rate of return on investments, rate of return on savings, the date you retire, social security, how much money you reserve as expenses, and pensions. Part-time earnings could also be included in this list. Of all these factors, the only one that is in your control is your spending. You can only spend a specific amount keeping in mind the other factors.

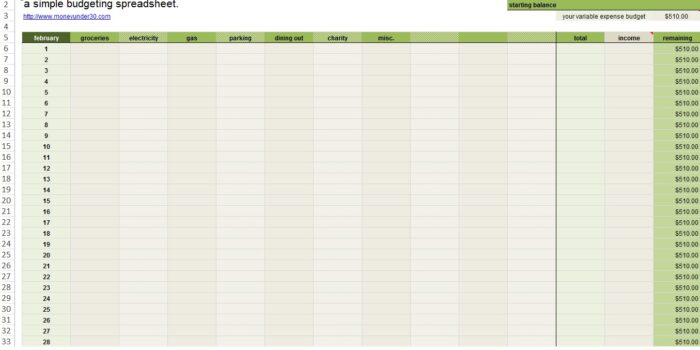

Example of Retirement Budget Template :

Download Simple Retirement Budget Spreadsheet

The first step in Retirement Budget Planning is making a list of all your fixed expenses. This list could have three parts to make it more effective. These are essential expenses, non essential but monthly expenses, and required expenses that are not monthly. Essentials include housing, food, clothes, healthcare, and transportation. Non essential but monthly obligations include cable TV, subscriptions, and other non essential services that you are billed for every month. Required expenses that are monthly include insurance premiums, property taxes, etc.

Healthcare expenses are a big part of Retirement Budget Planning. Healthcare expenses may vary depending on your age. Insurance premiums should be factored in here.

Download Retirement Monthly Budget Spreadsheet Template

The next step in Retirement Budget Planning is adding optional items in your budget like travelling, entertainment, and anything else that you like doing. Next, you may want to consider some lifestyle changes to keep up with the expenses. Decide what you are willing to change post your retirement. This will help in money allocation when you are doing your Retirement Budget Planning.

Download Retirement Budget Spreadsheet in Excel and DOC

The next step in Retirement Budget Planning is to add all your expenses and add all your fixed expenses separately. What you are left with is your variable expense or non essential expense. Once you subtract your non essential expenses from your total expense, you will know how much money you have left for your fixed expenses. If this amount does not meet the requirement for all your fixed expenses, you must consider cutting down on some of your variable expenses. As discussed above, this may include some lifestyle changes. It will depend on what is important. If you have always wanted to travel after retirement, you may consider living in a smaller house. If you can go for a walk every morning and evening, it may be a good idea to give up the gym membership. If there are subscriptions that you have but you do not need, get to rid of those. One thing is for certain that adjustments have to be made in the non essential expenses category. If you can do all this, your Retirement Budget Planning will be more effective.