Quarterly Budget Analysis Budgeting Process

Every well established business and companies rely on a proper financial management which is a vital key element behind their success. Good management of finances will enable business or company’s management team to meet their financial goals and have a profitable business year. Quarterly Budget Analysis is the most effective budgeting process that will help you to create financial plan for your business and help in motivating your employees. Below are helpful Quarterly Budget Analysis tips and guidelines.

Prepare Budget Calendar

Budget calendar is a schedule of financial activities that must be achieved in order to create and develop a successful Quarterly Budget Analysis. Budget planning calendar will provide the information that you will require to undertake the budget analysis. The budget planning calendar will give information such as: the adopted budget for the current financial year, provide revenue estimates and expenditures, the proposed budget for the upcoming financial year, recent audited financial statements, actual department revenue and expenditure data for the current financial year.

Analyze the General Indicators of Financial Condition

General financial condition is the ability of a business or an organization to balance the recurring expenditure needs with the recurring revenue sources while providing service on a continuing basis. Knowing your business’s financial position it is very important and it can be achieved through general indicators of financial condition which will help you in conducting a successful Quarterly Budget Analysis.

Conduct Revenue Analysis

An analysis on revenue from your overall business performance is a great way to help you in making crucial decisions regarding your business strategy. If you analyze your business revenues well then you will be in a position to carry out a successful Quarterly Budget Analysis. It will help you to determine key variables and calculate your business ratios to determine your overall business performance.

Analyze Your Business Cash Flow

Cash flow is the amount of finances that is moving in and out of your business. Positive cash flow means your business is doing well and negative cash flow will mean that your company’s liquid assets are decreasing. Analyzing your business at the quarter of the financial year will have a great impact during your business’s Quarterly Budget Analysis.

Define the Budget Variance of the Business

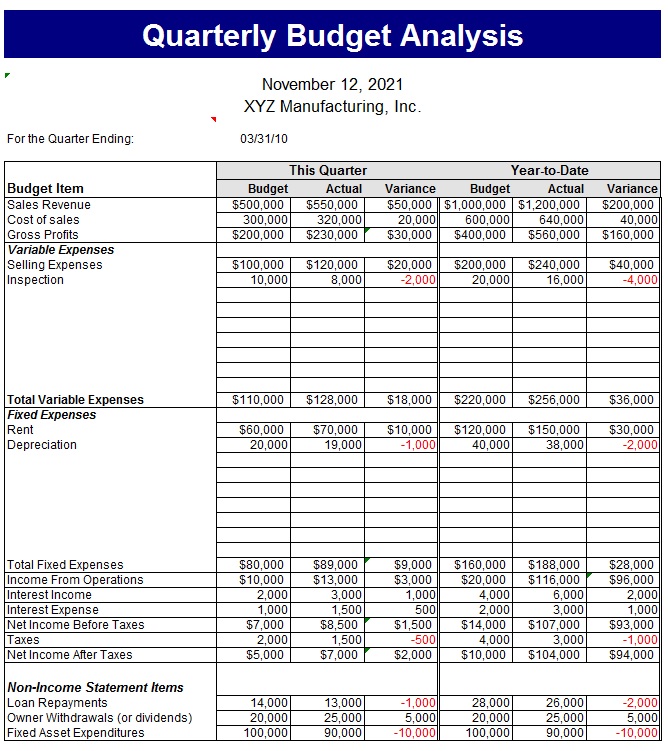

In the Budget Analysis process, you will need to put in to consideration the business’s budget variations. A budget variance is the difference between the budgeted amount of expenses, revenues and the actual amount of money initially invested in the business. A budget variance will be most favorable if the actual revenue is higher than the budget. Budget variance in most cases is caused by changes in sales, material cost or change in labor cost. So when you are conducting a business’s budget analysis, the budget variance will assist you to make any necessary changes in your business strategy. Lastly if you follow all the above tips and guidelines of budget analysis, you will be able to obtain the necessary and useful information to plan on your company’s financial needs.

Form a Quarterly Budget Analysis

Quarterly Budget Analysis Sheet Template

Comments are closed.