In order to better understand what mortgage amortization is, one needs to fully understand the two basic terms: Amortization and Mortgage. Amortization can be defined as when an individual pays off his/her debt in a fixed repayment schedule instead of paying off the debt via regular installments. To apprehend it in simpler terms, one can say that it is the process of decreasing and reducing the amount. Mortgage on the other hand is when an individual needs to raise his/her capital in order to buy or purchase a property and seeks out calender who as a guarantee needs that the title be transferred to his/her name until the borrower clears out all debts with interest.

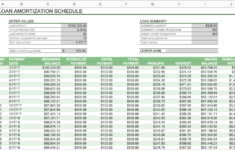

Template for Mortgage Amortization Schedule:

Download Mortgage Amortization Schedule Template

Download Mortgage Amortization Schedule Doc

Download Simple Loan Calculator and Amortization

Using Mortgage Amortization Schedule Template for Help

Without any doubt, you can have your hands with the following Mortgage Amortization Template, it can save you a lot of your time.

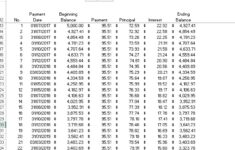

Amortization is used usually at the time of buying real estate property where over the life of the loan, some amount is decreased from the principal amount and the remaining helps in decreasing the interest amount. To help in knowing the ratio of this amount, an amortization schedule is developed to know what percent of amount is being decreased from the main principal amount and what amount is being decreased from the interest amount. When trying to pay back your mortgage while using the amortization process, you need to follow a few guidelines to help you in the long run.

Firstly, you need to calculate how much money will go in paying back the interest and how much money will go into paying back the principal. This can be done easily by using an amortization calculator where one needs to put in the mortgage amount along with the time period of the mortgage in years or months. Mention the annual interest that is on the mortgage along with the date your mortgage is applicable from. You will be able to know the exact amount that you need to pay each month along with how much percentage of the amount along with the actual amount goes into interest and principal amount. It is extremely important that you calculate this to give a better idea.

After you have your schedule made and the amount calculated, make arrangements for how you are to pay this amount. Many people get an extra job in order to pay back this amount while many sell their valuable belongings. It is best that along with calculation you find means of paying back to give you a better idea of how to do it. It is advised that a Plan B should also be thought in case your original means of paying back doesn’t work out. Next, make sure you consult an accountant with your calculations and your repayment methods to get an even better idea. Getting a professional insight will help you make better decisions in the future and you may get a better way to do the current thing. After you get the green signal from your accountant, you can go ahead and get your mortgage and buy the property of your dreams. Be very thorough and be very sure of what you are about to do. Happy amortizing!

Comments are closed.