Get Your Own Business Budget Template

The fundamental idea behind every good Business Budget is to balance your income and expenditure. Once this is done, you will be able to figure out how much profit you are making, how much you need to put into what, when to do it, and what impact your financial decisions may have. The first thing you need to do creating a Business Budget is to map out what your income sources are. You need to know how much money your business makes month to month. It is a good idea to start with the sales figures of your Business Budget Template. If you have other sources of income that you use for your business operations, include those too.

The next step is to make a list of the fixed costs of your business. Fixed costs are expenses that recur every month. For example, the mortgage for the property in which you have your offices is the same amount every month. This is an essential part of a Business Budget. Going through your bank statements from the past will help. Make a list of the fixed expenses and the total amount that you pay every month for them.

Then make a list of your variable expenses. Variable costs are expenses that differ from month to month. Variable costs can be increased or decreased depending on what state your business is in. Your monthly profit will help you in this regard. The earnings that are left with you after you’ve paid all the costs, fixed and variable, is your profit each month. If you are left with more profit than you had forecasted then you can use it to add to your variable expenses which will enable your business to grow faster.

Then you should predict your onetime costs. Expenditure like buying a laptop or any other office equipment is a onetime cost. A business retreat, planned months in advance, for training and recreation purposes is also a onetime cost. An effective Business Budget has all the four above mentioned key elements. Now that you know all the expenses all you have to do is put them all together.

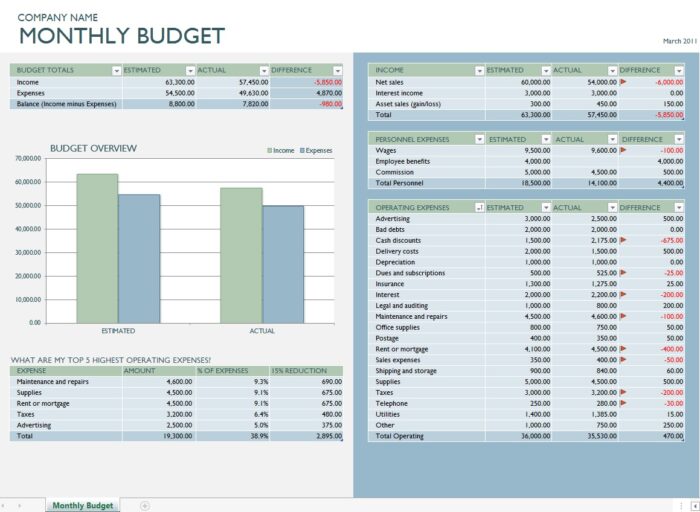

Monthly Business Budget Template

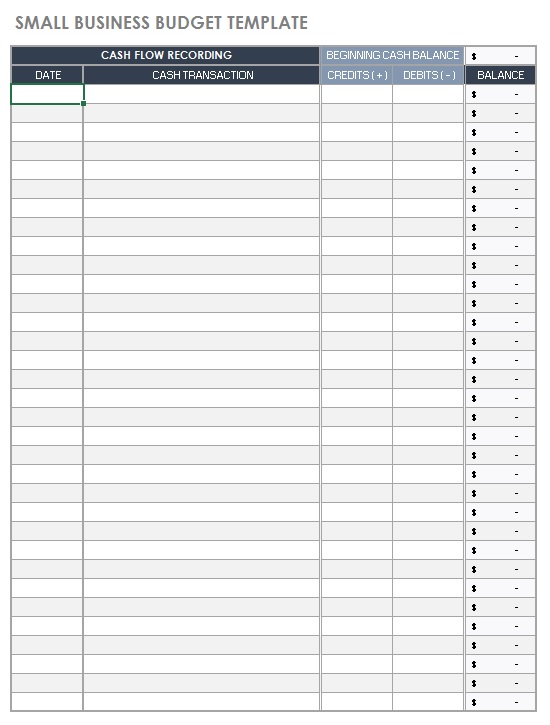

Small Business Budget Templates

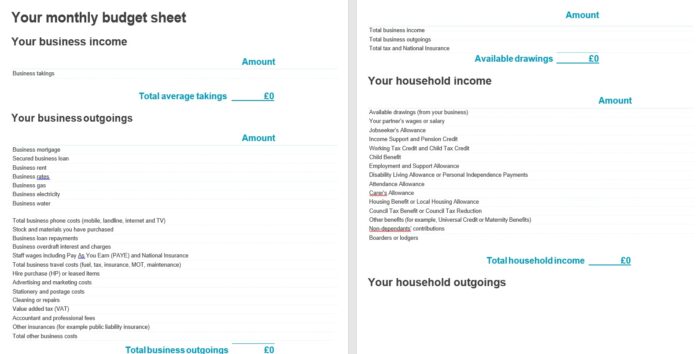

Business Budget Template Word

Consider the sources of your revenue and your cash flow or profit. Set a target for your profit margin. Do your own research about the industry you are in or consult a financial advisor to outline how much revenue you are likely to be generating. This minus your expenses is your profit margin. It is important to know this so that you know how much money you will have left over to put into capital expenses. It will also help you regulate your expenses.

After you have all this in place, it will be easy for you to make adjustments to your expenses. Usually, it is the variable expenses that are most likely to be adjusted based on profit. If you think you will not have enough money left to buy new office equipment in a certain month, you can defer it to the next. This is how a Business Budget helps.

Comments are closed.