A Business Acquisition Worksheet basically assesses the worth of a business. A Business Acquisition Worksheet comprises sales revenue, interests, depreciation, and total expenses. The key elements of Business Acquisition Worksheet are laid down here.

A Business Acquisition Worksheet gives an insight into the present liabilities and assets of a company. The current liabilities and assets should be analyzed this way. It can also predict the business’s future potential. Business Acquisition Worksheet can be downloaded online. Business acquisition is a normal process. Companies make new acquisitions in order to build revenue. It is also done to threaten competitors.

A business acquisition is when one business takes over another one. It requires planning because it is a very critical process. Machinery is scrapped in this process and old employees lay off. The management has to decide what is necessary and what is not. To be able to do this, a Business Acquisition Worksheet is absolutely indispensable. A Business Acquisition Worksheet should include information like hierarchy, departments, and policies. This is a true indicator of what the company is coming into. It will help identify the upcoming challenges that the buying company might be faced with.

Download Business Acquisition Worksheet Template

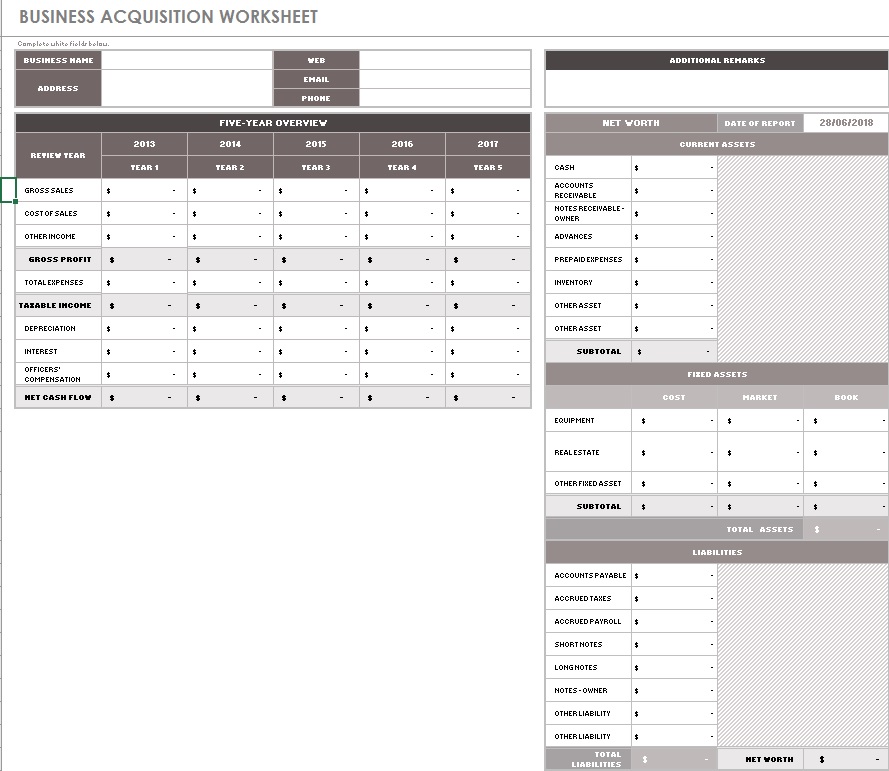

A Business Acquisition Worksheet should have the name of the business and its physical address. It should be followed by the gross sales. This is the gross sales of the company. Then the cost of sales or the price that a company pays to sell a product is mentioned. This should be followed by other income, if any, and the gross profit made by the company. Then calculate your total expenses based on all the above. Put in your taxable income. Depreciation should also be a part of a Business Acquisition Worksheet. Add an ‘interests’ column to it. After this add your net cash flow to the Business Acquisition Worksheet. This can be done for a period of five years.

A Business Acquisition Worksheet should also have information regarding current assets and liabilities. Current assets include cash, account receivable, advances, prepaid expenses, etc. Inventory is also a part of this. Fixed assets include equipment and real estate. Current assets and fixed assets make a total of the assets. Liabilities include accounts payable, accrued taxes, accrued payroll, short notes, long notes, notes/owner, and other liabilities. Make a subtotal of all of this.

A Business Acquisition Worksheet is a very handy tool to have when making predictions for your business. Once you take into account the past history of the company, it is easy to make forecasts of profits and revenues. Create cash flow statements, profit and loss statement, and balance sheet for the past five years. Begin by talking about the operation of the company and move on to products and services in details. The current profits and revenue of the company should be taken into account as well. Write a detailed and comprehensive summary of it. To set it apart from competitors, summarize the company’s strengths and weaknesses. Intellectual property and other patents also play a part in the value of your company.