The Break-even point in a business is the point at which a business generates revenue that is equal to the cost of business. In other words, the revenue of the business is as much as the money spent to generate that revenue. Break-Even Analysis is an analysis of a business’s break-even point. It is an analysis of the calculation of a safety margin for the business; a point at which revenues are larger than the break-even point. Here are some Break-Even Analysis tips.

A Break-even point in a business is where there is no profit and no loss. The total revenue earned is equal to the total cost of generating revenue. Break-Even Analysis is a method of cost accounting. It is part of CVP or cost-volume-profit. In Break-Even Analysis you need to analyze how many units of product your business must sell to recover the cost of the product and then make profit.

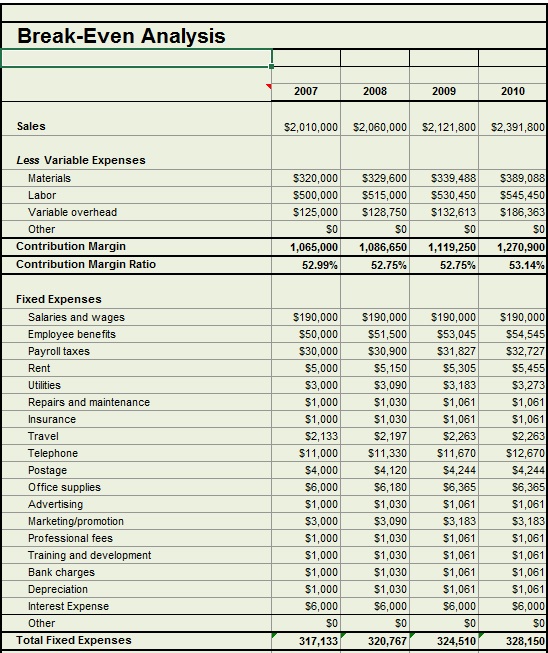

Break-Even Analysis Template Business Plan

In Break-Even Analysis, you must first determine costs and prices. While determining costs, first calculate your fixed costs like rent, property tax, insurance, utilities, and loan payments. These costs don’t vary depending on the number of units of product you sell. These remain fixed in spite of it. Next, determine your variable costs. Variable costs are those that change from month to month. These also change depending on the volume of production. Variable costs include raw materials for business, freight, and commissions that are paid to sales persons.

Then you must determine at what cost you want to sell your product. There are many ways of doing this. The most common way is to sell your product at the price that it took to produce it, at least. There are laws against selling a product below its production value. You may also have to take into account your target market, high-income or low-income, for example. After this you can calculate the unit contribution margin. The unit contribution margin is the amount that a unit brings in from the sales costs after taking away the variable cost in producing it.

The safety margin or the break-even point is calculated after taking into account the price at which each unit of product sells and recovers the variable cost that went into it. What is left after deducting the variable costs from the actual sales price is your break-even point or your profit margin.

The contribution margin ratio then needs to be calculated. This gives a percentage based on the contribution margin and the sales figures. Once you divide the contribution margin, that is the profit margin, by the sales cost, you get the contribution margin ratio. This will give you a percentage that can determine your profits from various sales costs and price. By dividing fixed costs by the contribution margin ratio, you will get your break-even point.

If you have a small business, it is a good idea to conduct a Break-Even Analysis for a short period like six months. A short-term Break-Even Analysis is more flexible. You can change it after the given period of time if you need to.