Planning an annual budget is a daunting idea but once you start planning the budget, it is really not that difficult. The common accounting terms and budget nomenclature is available online. You can easily create your own annual budget. For business, an annual budget is indispensable. Creating accurate and updated annual budgets helps maintain control over finances and shows investors where their money is being used. An annual budget must include projected expenses and projected income, the interaction of income and expenses, and adjustments you make in your business. Projected expenses are the money you have to spend in the upcoming financial year. This must be broken down into office expenses, salaries, etc.

Projected income is the money you think will come in the upcoming financial year from funding sources and sale of services and/or goods. If you get funding and there are restrictions on it, include these in your budget. Make sure you spend the funding the way it was intended. Finally, a budget is an estimate of things to come. The actual activities of the business need to be adjusted to the budget as closely as possible.

Using the Planning Annual Budget Templates

The reason for planning an annual budget is very simple. It helps you understand your financial goals. You get the real picture of what kind of health your business is in. With an annual budget, you can plan beforehand to meet the needs of the business, and to achieve you financial goals in any given year. You will also be able to deal with money more effectively.

Set your priorities for your business. It will depend on the stage of development your business is in. You must first make an estimate of your expenditure. The fixed costs include all the expenses that are fixed and recurring like yearly rent and salaries, for instance. Utilities and telephone bills are variable costs. Make allowances for unplanned expenses too. Make a list of expenses that you would like but cannot afford at the moment.

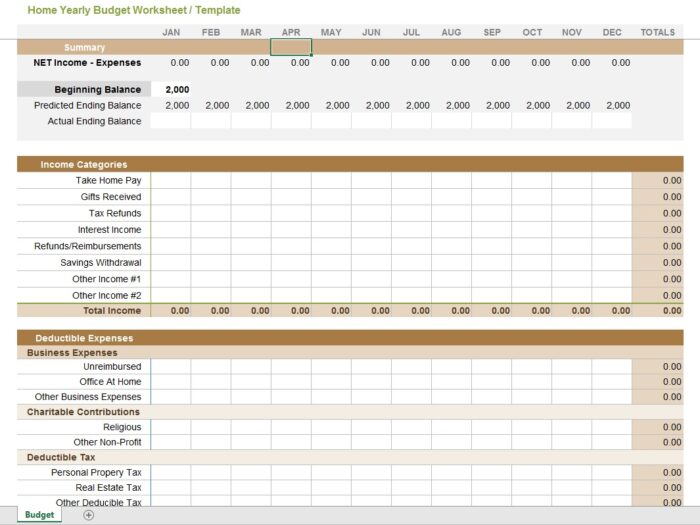

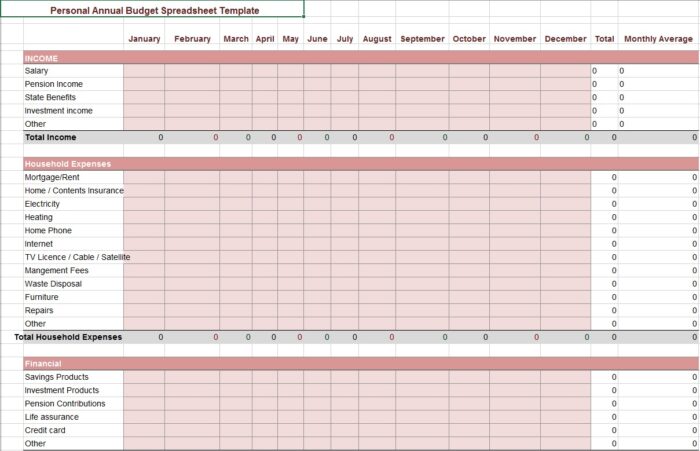

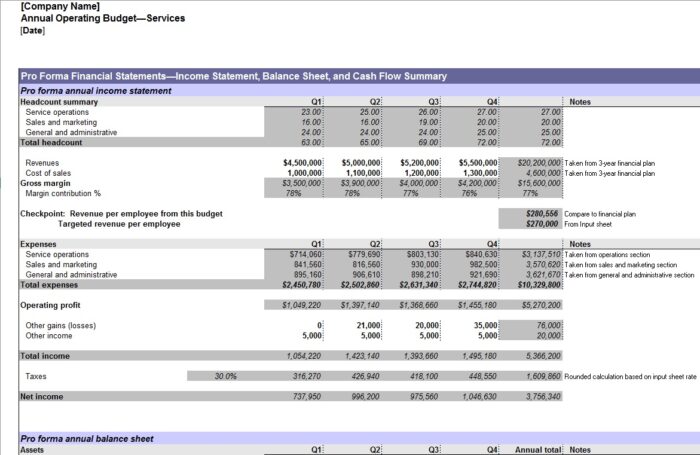

Create a spreadsheet with your sources of income along the top vertical columns. List your expenses along the rows. Now fill up the cells with the actual figures from your business. This will help you to calculate how much money will come in and how much will go out, and what you will have left. The amount left after all the expenditure is your profit. Based on the annual budget, you can either cut down on your spending or decide to infuse capital into your business. The spreadsheet should not be too complicated. It should be simple enough for everyone in the organization to understand so that they know what they have to work towards.

Planning an annual budget will help you set your financial goals for the coming year. It will also help you to figure out if you need to pitch for more funding. It will help you make adjustments in your financial activities so that the ground reality may be adjusted to be as true to the budget as possible.

Personal Annual Budget Templates

Annual Operating Benefit Template

Annual Yearly Budget Template