Account Statement Report will show all the transactions for general ledger account with subtotals per account statement over the period of time. This report will show all the monetary activity in the account. Account statements are created so that all the statements can be shown at once. In this article we will discuss the helpful tips for Account Statement Report.

Determine Time Frame

Before you begin to create Account Statement Report, you will have to decide the period of time that the report will cover. Most companies prepare financial statement reports annually and quarterly, although some companies prepare them on monthly basis. In order to determine the time frame that the report should cover, you will need to review financial documents of the organization. These documents will enable you to know how soon should the financial reports be prepared or you can as well speak to the executive staff and find out how often should the reports be prepared according to the company’s rules and regulations.

Review All the Ledgers

This is the next move in Account Statement Report creation. You will need to review and make sure all ledgers are updated and recorded properly. Ensure all payable and receivable accounts have been processed. All inventory purchases and product sales should be properly recorded, and you should also make sure all the bank reconciliations have been properly verified and are complete. Also you need to consider all any liabilities that might not have been recorded by the time of creating the Account Statement Report. You should track down and gather any missing information that is needed to ensure that the financial report is correct and complete.

Prepare and Format the Balance Sheet

A balance sheet will indicate the company’s assets, liabilities and financial accounts for specific date or for a period of time. Format your balance sheets appropriately. A well balanced sheet will feature assets on the left and liabilities on the right in an ideal format. Before you prepare an Account Statement Report, first you will need to make the list of the company’s assets. When you are making the list of assets, you should start with current assets like money or any other items that can be converted into cash. Next on the list should be the non-current items, then you add the current and non-current subtotals so to get the total number of assets and you do the same for liabilities.

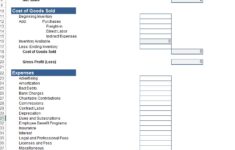

Create Income Statement Page

Income statement will clearly show the amount of money that the company earn and spend over a period of time. Then make a list of different sources of revenue. An Account Statement Report will ensure that each type of revenue source is reported separately and adjusted if need be. The report should also include the records of all operating expenses that are necessary in running the business. This operating expenses will include rent, salaries, administrative expenses, and miscellaneous. When you are preparing this report, leave a room for any other additional relevant information.

Download Account Statement Report Template (MS Excel)

Download Account Statement Report (MS Excel)

Download Account Statement Report in Excel