When it comes to our money, many of us have a hard time keeping track of everything. Because of this, you may be forced to pay fines for outstanding invoices. The use of a bill pay checklist or a payment calendar may be one solution to this issue. You may list all of your monthly invoices and then sort them according to their due dates with this bill template.

Checklists for bill payment

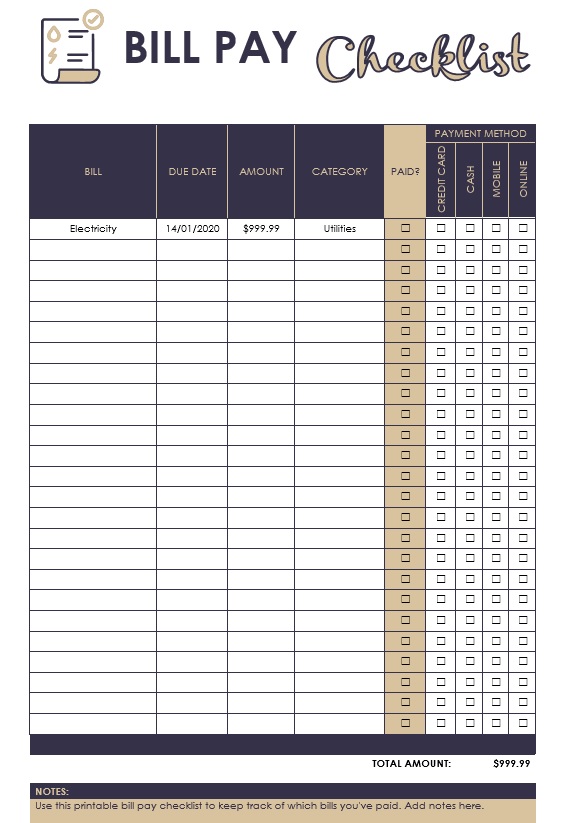

When you have so many expenses to pay each month, it may be difficult to keep track of everything. Paying your payments on time may be challenging, particularly if they are due on various days of the month! One method to keep track of everything is to use a bill pay checklist, and this is a good place to start. Printable bill trackers include the following:

This is a record of my monthly bill payments.

It will be simpler for you to keep track of your monthly bill payments if you use this record or checklist. Make a template or create one from scratch, print a few copies, and keep it handy so you can see when a payment is due. In your notebook, checkbox, or other convenient location, you may maintain this journal.

Bill-paying Logbook for the Year

You may use this sort of checklist if you want to keep track of everything that has to be done during the year. An annual bill organizer will show you all of your upcoming invoices for the next year. It may also be a vital part of your financial management system or binder.

Checklist for keeping track of your home’s budget

It’s not simply the expenses that you have to pay that make up your total home budget. Additionally, you must include the cost of your family’s food, school fees, and other essentials. Keeping track of all of your spending is a great way to stay on top of your budget. Additionally, you may put pertinent information on your checklist, including things like invoices.

- The family’s overall income

- Indebtedness or borrowing

- Utilities

- Insurance and the cost of paying for it

- Savings and investments

- Additional costs

Checklist for home upkeep

The costs of home upkeep should also be included, as they are part of your household expenditures. Keeping a checklist like this can help you when it comes time to figure out how much money you’ll need to spend on house repairs in the future.

A bill-paying checklist should include the essentials.

It’s easier to keep track of all your bills in one spot. The monthly bill organizer may be saved to your phone or printed out and stored together with your other financial records. Your chances of missing a single monthly payment are little to none. Include the following essential aspects in your writing, regardless of the style or format you use:

Each of your impending monthly expenses is shown graphically.

All of your impending bills should be included in chronological order on a decent checklist. List your invoices in this sequence when creating your template or when entering data into an online template. In some cases, the bills are arranged alphabetically, while in others, the dates are listed on a calendar. When it comes to organizing your finances, think about the style and layout you want.

This month’s total amount is owed for all of your bills.

Having the amount owing for each of your expenses listed would be quite helpful if you wanted to make a long-term financial strategy. Every time your paycheck arrives, you’ll know exactly how much money you have left to spend.

How many times a year do your debts come back?

Even while most bills are paid on a monthly basis, there are a few that don’t, and these are the ones that are most often overlooked. For example, if you only get your auto insurance invoices twice a year, it’s easy to overlook them. As a result, you can create yearly checklists that contain all of your expenses, ensuring that you never miss a payment.

a way to keep track of all of your monetary transactions

Finally, your checklist should include a way to keep track of all the payments you’ve previously made. For example, you should be able to provide any confirmation or reference numbers you may require in the event of payment issues. Alternatively, you may just check the boxes next to the invoices’ names as you pay them, rather than arranging them alphabetically.

Creating a bill pay checklist

This monthly bill template is popular with many individuals since it serves as a handy reminder of all the payments that need to be paid. It’s only a matter of scanning the list to determine what’s been paid, what’s due, and what hasn’t been paid. This month-to-month budget template is as easy to use as it seems. When you have a checklist, even if you don’t get your bill on time, you’ll still remember to pay it. Here are a few things to keep in mind while putting up this list:

- When you have to pay a bill, write the company’s name and the due date.

- All your bills, including those that are automatically paid by debit or credit card, should be included in your financial records.

- Make a list of all of your upcoming due dates so that you can prioritize which ones are most important.

- In order to avoid forgetting about the invoices that don’t arrive on a monthly basis, add them as well.

Paying your bills? Here’s how to do it.

It’s quite simple to utilize a bill-paying checklist if you become accustomed to it. To get started, collect all of your invoices and sort them by the due date before utilizing this checklist. Then, write down each bill’s total amount on your list in the order you’ve arranged it, along with the date it was due.

To make things even easier, please add the date of each paycheck so that you know when to submit the bills for each cut-off date. Make a note of the payment or reference number for each bill you pay by ticking the box next to it.

Pay all of your bills in this manner. Monthly bill payment logs may be necessary if you wish to include invoices that don’t arrive on a regular basis. It’s really simple!

Other ways to keep track of your finances

Most of us are chronically chaotic when it comes to keeping track of our financial information and paying our bills. We frequently forget about our monthly, quarterly, semi-annual, and yearly bills because of all the other things we have to deal with on a daily basis. Organizing your bills doesn’t have to be limited to utilizing a bill calendar or a bill pay checklist.

- Keep all of your receipts in one location, such as a binder or a transparent book, once you’ve made your payments. If you deal with both personal and commercial payments, this will make it easier for you to maintain track of your payment history.

- Make a spending and payment plan that is tailored to your individual requirements and financial position. If you can’t make use of a free printable bill tracker you discover online, consider tweaking or creating your own.

- Create a binder that serves as your money management system. You may use it to keep track of your to-do lists, bills, financial transactions, and more.

- Expanding your financial systems and creating a comprehensive financial cabinet at home is possible if you have more than just your household expenses to pay. You might, for example, buy a cabinet with numerous drawers and mark each one individually. Keep a binder in each of your drawers that have all of your financial records. It’s best to maintain duplicates of the most crucial papers on hand and store them somewhere in case of a fire or other disaster.

- Bills aren’t the only thing you can arrange using cabinets and binders. In addition to medical bills, personal records, and other paperwork, you may utilize these platforms for other purposes.

- You may even want to give the envelope budgeting approach a go. Envelopes containing a little amount of cash are kept for this purpose. That’s all there is to it after you’ve spent everything in the envelope! Until you get your next salary and can replace those envelopes, you shouldn’t spend any more money.

- There are some folks who like using bullet diaries as well. You may use these journals in the same manner as a monthly bill organizer to keep track of all of your financial transactions.

Bill Payment Checklist Sample