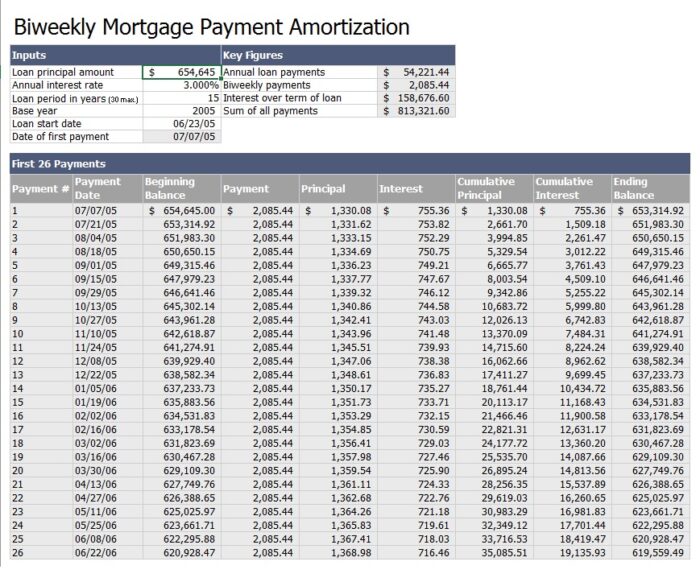

The accomplishment of full mortgage settlement is greatly dependent on discipline and full follow up of the set Biweekly Mortgage Amortization Sheet. As it’s the dream of many to apply and be granted mortgage by your financing partner or rather the bank. It’s essential for one to understand the institutions re-payment guidelines and as for the lending institutions it’s important to consider a Biweekly Mortgage Amortization Sheet that will not only see the full principal and interest re-payment accomplished, but also one that will enable their client make it through without deficiency and defaults. There are key elements of Biweekly Mortgage Amortization Sheet to watch while setting one and working by the same.

Payment Dates

The payments should be outlined correctly as missing one might cost one financial trust. This should be in the first column as it’s the most specific guideline towards the repayment of the financed asset which in this case is the mortgage. Although Biweekly Mortgage Amortization are different and of different elements they all have this in common and therefore it’s important to be prioritized within the creation of the Mortgage Amortization Sheet.

Monthly Repayments

This is another important element indicated by a row to show how much one is supposed to pay at each time on every installment of the repayment schedule. The amount on this column should be the same, as the borrower. One should take it time to make sure that this element’s character should be in place.

Up To Date Interest Rates

It is highly advisable that the Biweekly Mortgage Amortization Sheet be flexible. By this, it creates room for change in the case where the current interest rates change. This might be different under different currencies and kind of accounts. If a currency gains or depreciates within the repayment period, it’s obvious for the interest rate to be affected or rather the whole interest in particular. In most cases it’s advisable to do the calculations on local currency; by this the interest is normally not affected in the fluctuation of international currencies. The interest changes should not be mistaken on the column of the cumulative interest as this will increase as the repayments go on, cumulative interest will start calculating from the second row as the digits on the first row are all considered initial figures.

Beginning and Ending Balance

These two elements are important as they decrease the repayment proceeds. The first row should be different from the second one. The begging balance on the Biweekly Mortgage Amortization Sheet should be different from the ending balance column which alternates as you go down. It’s important to note that the previous repayment ending balance on the Biweekly Mortgage Amortization Sheet should be the current begging balance.

Principal

The principal represents the total amount the mortgage went for; this is exclusive of the interest. On close observation from the Biweekly Mortgage Amortization Sheet, the interest depreciates as the principal appreciates. In most cases the margin between the changes is small but should be noted as it assists in calculating the period left for the repayment against the repaid amount. This element will at the end calculate the total principal against the initial one.

Biweekly Mortgage Amortization Sheet Template Excel