Calculate Gain on Sales of a House

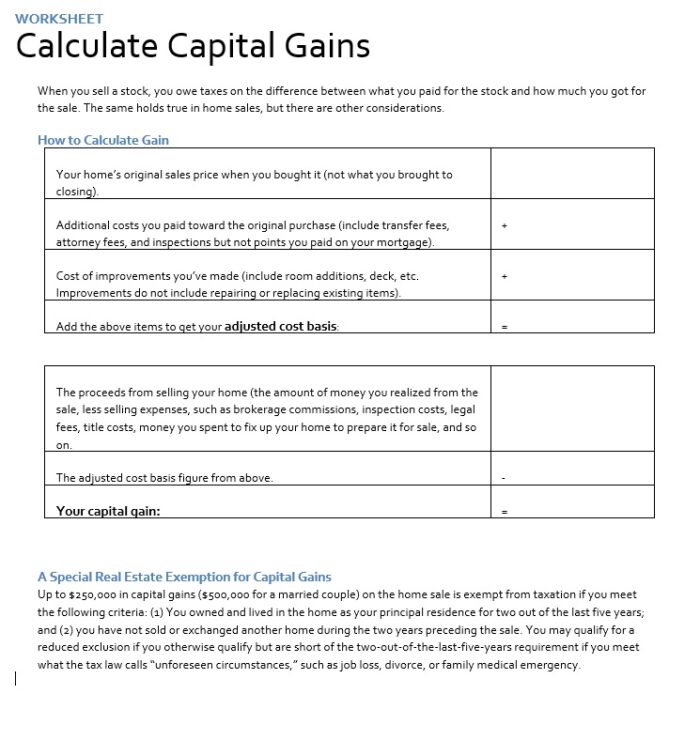

If you want to know the gain on your sold property, you need to do some calculations; some additions or subtractions to have a net amount in hand. There are three main areas which play a major role in estimating the capital gain, these are the original purchase amount, the closing cost which has to be paid for the selling process, but remember no loan is included in this amount. Third is the amount you have spent in remodeling or renovating the premises. Then all these costs are added and subtracted from your sale basis. The sale basis means the actual amount that is in your hand after completing all the processes and paying commissions. To start the calculation, to determine the gain on your property sale you have to move in an organized manner

Determine the new cost is based upon the addition and subtraction of the expenses experienced during the time you were residing in the house or you have the house as your property. You might have done some improvements in your property before. Include all the materials and labor required for new fixtures, replacing cost and any renovations that you have made in the house or property since when you purchase it .It might be the renovated patio or simple flooring. It does not require those costs that are spent on landscape. Now you have determined the cost which you have spent in improving your property since when it is purchased. Secondly, It’s time to estimate the cost that you throw for processing and transferring of the property sale. insurance, underwriting, flood determination, realtor commission and survey fees and taxes are included in such categories. Cost of review and credit report is not calculated in such zones.

A point of consideration is that, if your property is refinanced and the points you are paying are still amortized, then you can claim for the amount that has yet not deducted in the sale year. This procedure is not valid if the loan fees or payments for points are already deducted with mortgage interest in the purchasing year. Paying the retailer tax debt increases the cost of your home. Here you should be aware of the thing that if the property is sold within three years of purchase, then it is taxed with the slab rate but if you are selling the property after three years of purchase, then your profits act as a long term capital profit, which is taxed at 20%. Don’t include the amount of downgrading you could have claimed if you have used the premises as a business region. Cost that has applied for refinancing should also not consider while calculating the gain.

The term basis has to be understood while selling a home for a gain. Basis is the amount your home value for tax purposes and when you sell your home, your profit or loss for tax purposes is determined by subtracting the basis amount on the selling date, which is inferred from the sales price including the sales expenses.

Gain on Sales of a House Sheet