Many people choose to refinance their mortgage. Refinancing your mortgage means that you plan to replace the old mortgage with a new one to allow the borrower to get a better interest rate along with an even better interest term. Note that refinancing can only occur when the borrower has paid off the first loan completely. Then only can he/she seek out a new one. Various factors are tied to when a borrower considers refinancing his/her mortgage.

The first one and one of the major ones is that the market is seeing a low and there is a chance that the borrower might get a lower interest rate. Since the interest rate has a direct link to the amount of money a borrower needs to pay back, he/she would naturally opt for a lower interest rate which would mean less money to be paid back each month. The second factor is when one wants to find a mortgage package where the mortgage term is longer. The longer the mortgage term the lesser amount of money would the borrower need to pay each month. The third condition or factor that few people look out for is seeking out a mortgage term which is less since more than often lesser terms have lesser interest rates with them.

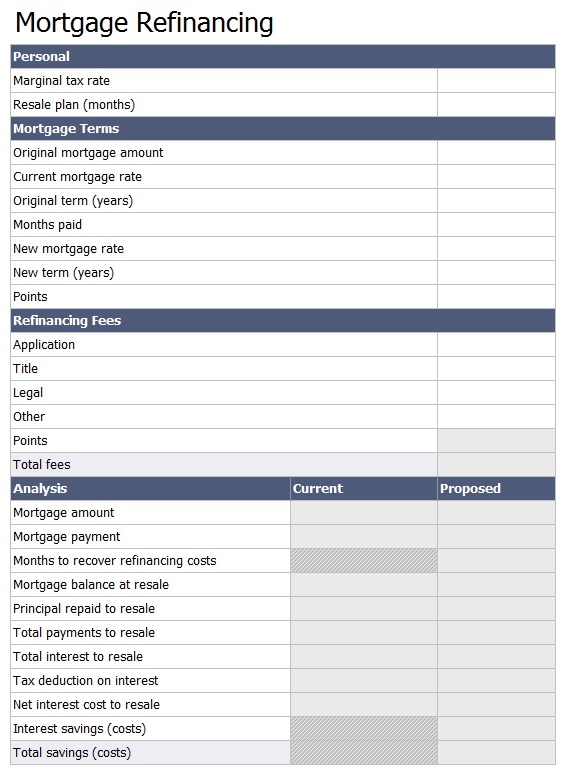

Mortgage Comparison Spreadsheet Excel

When seeking out to refinance your mortgage, it is best to know a few tips ahead of time. Firstly, make sure that you have paid off your previous mortgage. You are one hundred percent mortgage free at the moment and have completed your mortgage term. Often people miss out the fine print and get themselves owing a bit more even after they think they have paid back what they owe. Secondly understand that for your current lender, making a new customer is MUCH difficult than to keep an existing one. It is advised that you seek him/her out to know about what other options can you benefit from. Your current lender will be able to give you a better deal and a better package as opposed to if you seek out a new one. He/she will exhaust his resources to give you a better deal to make you stay. He/she doesn’t not want to spend out more on property appraisals and seek out a new borrower. Your current lender will give you a much better deal for refinancing. Note that it is advisable and not necessary. If you are getting a much better package elsewhere, then go for it! Third, note that the refinancing process can take up to 90 days, which gives you time to correct out your credit history if you have any mistakes. Pull out your report and correct your mistake. Always make use of a refinancing calculator tool available online to make sure that your decision of refinancing is the correct one. Seek out a reliable accountant with that information and understand fully if refinancing at the moment is the right option for you. With refinancing, go in deep and go through it extensively.

Mortgage Refinance Calculator Excel Templates