Start-up Capitalization is the first amount of money that an investor or a business person has to invest into a business so as to start or open the business doors. The Start-up capitalization will have long time impact on your business success. You can fund your Start-up business from your own savings but if you do not have enough funds you can request loans from banks, Sacco or get soft loans from relatives and friends. It is not easy to fund a Start-up business expenses, inventory and operations, so it is important that once you have a solid and comprehensive business plan, you conduct a Start-up Capitalization Analysis before you invest your money into the business. In this article, you will find useful Start-up Capitalization Analysis guidelines.

Business Plan:

For you to effectively conduct a successful Start-up Capitalization Analysis, you need to have a business plan which is an important roadmap for your business success that will illustrate your industry and the business market Knowledge. A business plan is a formal statement that shows the business goals and plans of achieving them. This will include the business funding and so you will be able to the amount of capital that is required to start the business.

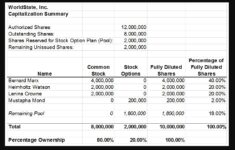

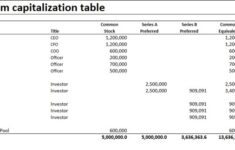

Here is Preview and Download Free Start Up Capitalization Template

Free Startup Capitalization Template Image

Startup Capitalization Template Sample

Startup Capitalization Costs Template

Source of Funding:

You can fund your Start-up business from your own pocket but if you are not affording then it is important for you to understand the types of capitalization. There are two main types of business capitalization: equity funding and debit funding. Equity funding means the ownership of the business could be in stock or shares that you can sell to other investors to raise the Start-up capital or you can legally get into partnership business with other willing business people. Whereas, debit business funding means you will get funding from the banks in form of business loans that will be issued to your company. Start-up Capitalization Analysis will help you to analyze and understand the most appropriate type of capitalization for your business.

Capital Required:

For a successful Start-up Capitalization Analysis you need to estimate the amount of money that you need to invest into the business. For a Start-up business, you will need inventory capital, miscellaneous expenses and operations capital. You will need to analyze the capital you will need to fully fund the business.

Target Market:

It is important to figure out your business target market. It will help you to know the type of product for the business and know the products that you need for a Start-up business. You will be able to know the amount of capital needed to stock the products. Knowing your business target market will help you in conducting an effective Start-up Capitalization Analysis.

Challenges:

Before you conduct a Start-up Capitalization Analysis you need to know the challenges that the business might face in the near future because this challenges will have a huge impact on the business and the initial capital that you invested. All the above described elements will help you accomplish a better analysis for start-up capitalization of a business.